Recent amendments to the CGST/SGST Act, IGST Act, and CGST/SGST Rules have introduced new obligaƟons for persons located outside the taxable territory who provide online money gaming services to Persons within the taxable territory. According to these amendments, such Persons are now required to register for the Goods and Services Tax (GST) and remit taxes on these services. This means that anyone situated outside the taxable territory who supplies online money gaming services

to Persons in India must undergo the registration process, or modify their existing registration if

applicable, in accordance with the newly introduced Row (iia) in FORM GST REG-10. Additionally, they must provide information about these supplies in the proposed Tables in FORM GSTR-5A. The Goods and Services Tax Network (GSTN) is actively working on implementing the functionality to facilitate these new registrations or amendments as necessary.

In the interim, while the portal’s functionality is being developed, we recommend the following workaround:

1. Registration (Form GST REG-10):

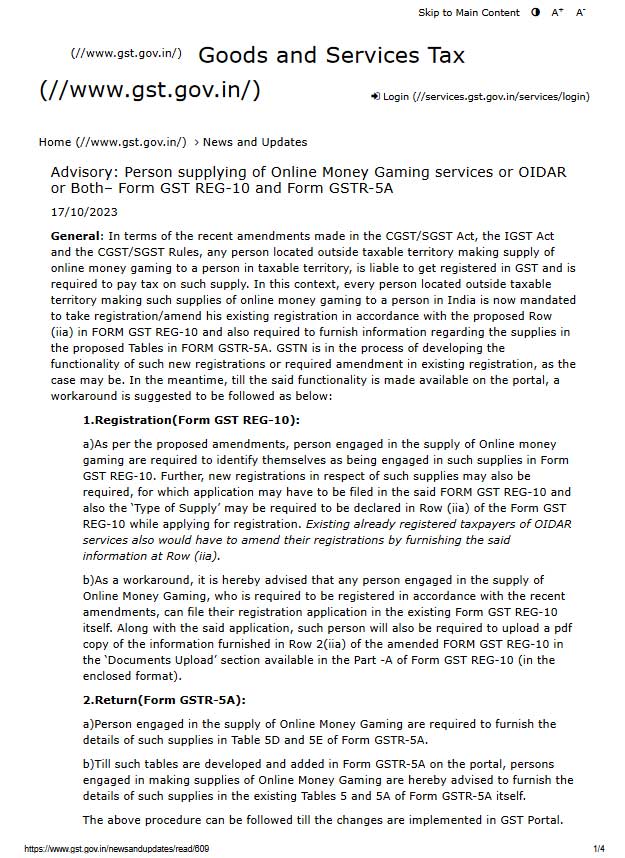

a) As per the proposed amendments, Persons engaged in providing online money gaming services must identify themselves as being involved in such services in Form GST REG-10. New registrations pertaining to these services may also be required, necessitating the filing of an application using FORM GST REG-10. The ‘Type of Supply’ information should be declared in Row (iia) of the Form GST REG-10 when applying for registration. Existing taxpayers who are already registered for Online Information and Database Access or Retrieval (OIDAR) services must amend their registrations by providing the required information in Row (iia).

b) To address this situation, it is advisable that any person engaged in the provision of Online Money Gaming services, who is obliged to register as per the recent amendments, can submit their registration application using the existing Form GST REG-10. Along with the application, such Persons must upload a PDF copy of the information submitted in Row 2(iia) of the amended FORM GST REG-10 in the ‘Documents Upload’ section available in Part-A of Form GST REG-10 (using the provided format).

2. Return (Form GSTR-5A):

a) Person engaged in the supply of Online Money Gaming services are required to furnish details of these services in Table 5D and 5E of Form GSTR-5A.

b) Until the necessary tables are incorporated into Form GSTR-5A on the portal, Persons providing Online Money Gaming services are advised to provide details of these services in the existing Tables 5 and 5A of Form GSTR-5A.

This procedure is recommended as a temporary measure until the anticipated changes are fully implemented on the GST Portal.

About author

RAJANI AGGARWAL is a proprietor at Rajani Aggarwal & Co. She has more than 12 years of experience in Financial Management, Tax planning, Statutory compliance and Corporate Governance. Rajani holds professional degrees of Company Secretary from Institute of Company Secretaries of India (ICSI) in 2016, Cost and Management Accountant (CMA) from Institute of Cost Accountants of India (ICAI) in 2010 and certification in Intellectual Property Rights from ICSI. She is graduated from Delhi University in year 2010. You may write her at cs.cmarajani@gmail.com